The $80,000 Question.

One of the statistics that has come up more and more in my conversations about The Future Poor is the Median Household Income in the US.

What is it?

$80,610 (according to 2023 US Census data)

Why does this number jump off the page at me?

Going back to early math education, we learn that median in the middle value of a data set, like every household income.

This means that 50% of the US households make less than $80,610 and 50% make more. My concern centers on the 50% that make below and asking the serious questions about their economic stability moving forward. More than likely, it is economically unstable given the data on rising cost of living.

One of the solutions offered is to max out your retirement savings in your 401(k). According to Vanguard, less than 15% of people ever do that. For 50% of households, maxing out would be 30% or more of their income.

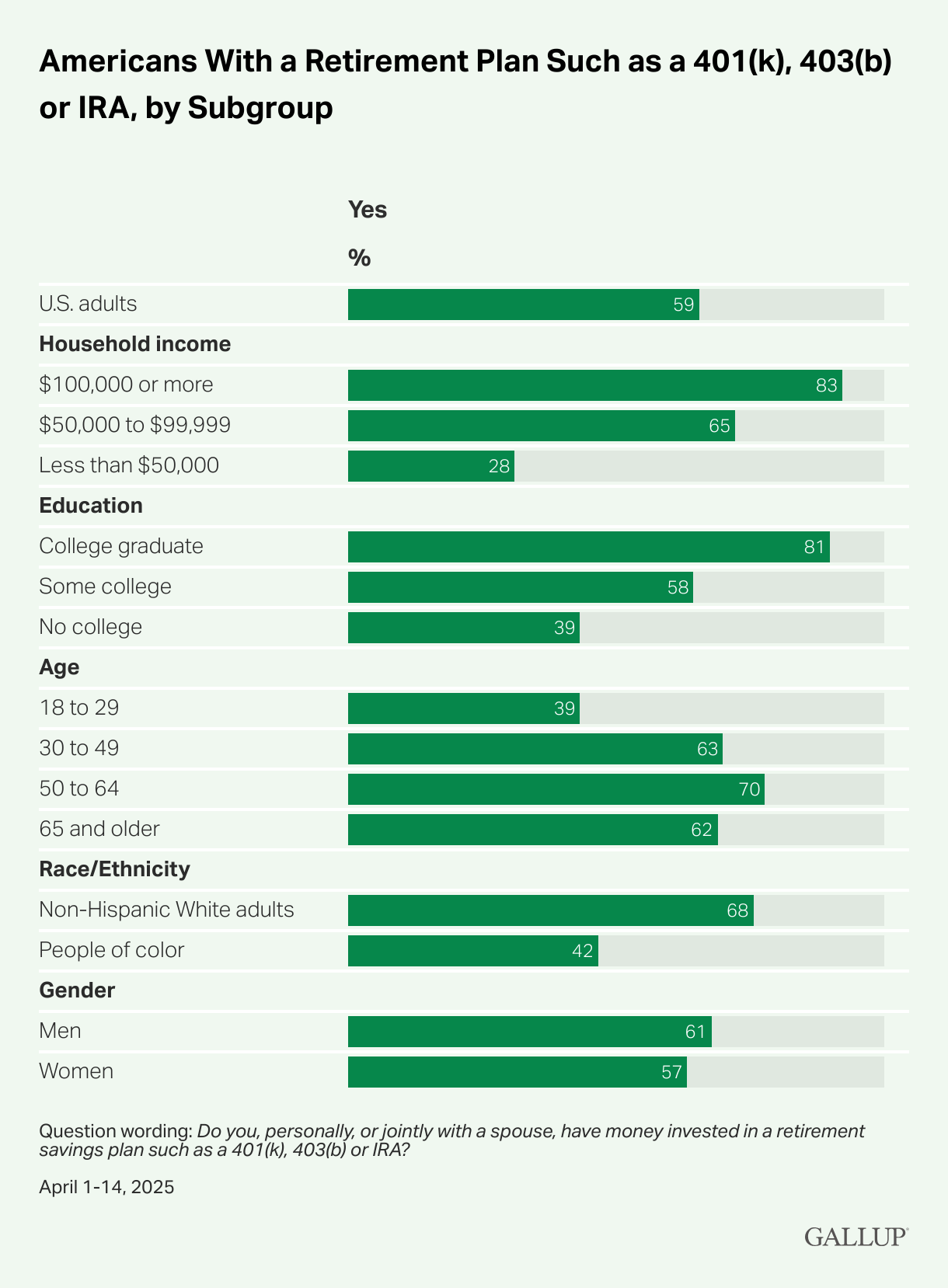

Gallup notes that only 59% of adults have a 401(k)

And, the less income the less likely you are to have this type of plan. LIke many financial stats, they tend to skew much more in the favor of a highly educated, higher income earning white male rather than other demographics. This should ring alarm bells for us on a number of levels.

$80,000 is the midpoint. Half of households are below that level and that should cause concern. It continues to be eye-opening for me and curious about what professional financial advice is actually helpful for half the country.

As always, if you come across a financially related article you’d like to send my way please do!

Best place to send them is to me.

More next time!

Jonathan